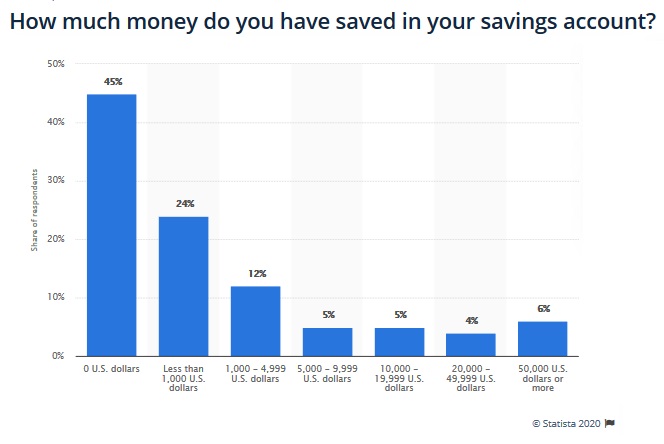

As we grow our list of expenses starts to expand as well. While you may need extra funds to pay for your college or university tuition, you will face even more expenditures after graduation. Do you have small monetary disruptions that can be solved with a 500 dollar loan? According to statistics, about 45% of Americans don’t have money on their saving accounts and can’t cope with any money issues. If you also didn’t save money before but really need them now, 500 dollar loan is a good solution to solve the majority of financial problems.

While purchasing your own home or saving for retirement are the examples of big-ticket expenses that happen once in a lifetime, there are numerous day-to-day costs that also need your attention… and money. Of course, budgeting and financial planning are great but there are urgent situations when you don’t have time to wait until the next paycheck. Acquire a 500 loan from SameDayFin with no effort and save your precious time.

What Is a 500 Dollar Payday Loan?

A 500-dollar payday loan is a type of short-term, small-dollar online loan that allows individuals to apply for a $500 cash advance. To get approved, borrowers typically submit a loan application through a lender’s website or app.

These loans are designed to cover immediate financial needs and are expected to be repaid, along with fees and interest, on the borrower’s next business day. While they offer quick access to funds, 500 payday loans often come with high interest rates, so borrowers should carefully consider their options before applying.

A $500 Loan with No Credit Check – How Is It Possible?

A $500 loan without a credit check is a financial option for individuals who need a $500 cash advance but have not perfect credit. Borrowers can apply for a 500-dollar payday loan with no credit check, which means that the lender doesn’t assess their history during the approval process.

This can be advantageous for those with damaged credit records. However, these loans often come with high fees and interest rates. Borrowers must pay back the loan, typically on their next payday, making it essential to carefully consider the cost and explore alternative borrowing options to avoid potential debt traps.

Will a Lender Perform Any Checks for a 500 Dollar Loan?

When you apply for a $500 loan, most lenders will indeed perform checks to determine your eligibility. These checks are essential for them to assess the risk associated with lending you money. Here are some of the typical checks they may conduct:

1. Credit Score Check

One of the primary checks that lenders perform is a credit score check. Your credit score is a numerical representation of your creditworthiness and financial history. Lenders use this score to gauge how likely you are to pay back the loan. A higher credit score usually indicates responsible financial behavior and can improve your chances of approval.

2. Income Verification

Lenders also verify your income to ensure that you have the means to pay back the loan. They may request recent pay stubs, bank statements, or tax returns to confirm your financial stability. This step helps lenders determine if you can comfortably manage the loan payments.

3. Employment History

Your employment history is another aspect that lenders may examine. They want to ensure that you have a stable job and a regular source of income. A steady employment record can boost your chances of loan approval.

4. Debt-to-Income Ratio

Lenders often calculate your debt-to-income (DTI) ratio, which compares your monthly debt obligations to your monthly income. A lower DTI ratio suggests that you have more disposable income available to repay the loan.

When you’re considering a $500 loan, it’s crucial to be aware that lenders do perform checks to assess your eligibility. These checks encompass various aspects of your financial history, including your credit score, income, employment history, and debt-to-income ratio. Understanding these checks can help you prepare for the loan application process and increase your chances of approval.

$500 Cash Advance Payday Loan Online Lenders

-

HonestLoans.net: Overall $500 Cash Advance Lender

-

QuickCashAdvanceUSA: for Short-term Cash Advance

-

CashForLoansNow: Bad Credit Option

-

FastMoneySource: Quickest Approval and Release

Getting a 500 Dollar Loan with Monthly Payments

There may be several ways to obtain the necessary funding. When people face hardships and want to fulfill the urgent cash need, they often think about turning to traditional crediting institutions or local banks. Are you ready to cope with all their stringent requirements, tedious fuss and unwanted paperwork? If not, here is a better deal for you.

Getting a quick 500 loan from a direct lender does not have to be a synonym of “impossible”. In fact, you can easily perform the whole process online from the comfort of your home and receive the funds faster. SameDayFin is your best friend to help you bridge the short-term money gaps and stay financially afloat. We can facilitate this process so that your small disruptions will vanish in no time.

How to Get a 500$ Loan

Do you need just this small sum until the next paycheck? There are multiple situations that we can’t predict but they all require our financially sound decision and quick choice. If you don’t want to risk losing your time or getting a rejection, our experts are here to help you out. We are not the direct creditor but we can try our best to help you acquire the most advantageous same day payday loans. We won’t ask you the reasons as it’s your personal matter.

While you can’t improve your earning potential right away, we fully understand that it may not always be enough to fund everything with a single paycheck. Why don’t you opt for a $500 payday loan that will save your day? Not only big-picture goals require extra funds, but everyday expenditures such as urgent or late bills, medical costs, urgent auto or home repairs may become common disruptions that will try to knock you off the wagon. Stop worrying! Luckily, a fast $500 personal loan can save you!

How Long Will I Have To Wait Before Receiving My 500-Dollar Loan?

The time it takes to get approved for a loan can vary. Typically, if you apply for a 500 dollar loan online, you may receive a decision within minutes to hours. Some lenders offer same-day approvals, allowing you to access the funds quickly. However, the exact wait time depends on the lender’s processing procedures and your eligibility, so it’s possible to secure a $500 loan relatively swiftly when needed.

Apply for a 500$ Payday Loan Here

Are you afraid of strict rules or high demands of lending institutions? SameDayFin.com is here to help you out. We assure you that the creditors we work with won’t have high expectations or stringent requirements from prospective consumers. Indeed, in order to be creditworthy and eligible for a 500 dollar payday loan, you need to:

- Be over 18 years old

- Be a citizen or have a valid US residency

- Provide your email and phone number

- Have an active checking account for the money deposit.

As you can see, we have minimum requirements and offer maximum support throughout the whole process. Free free to contact us and visit our website if you have extra questions. Pay attention to all the details before taking a loan. Are you thinking about obtaining a 500$ cash loan? Submit your request online and we will make everything possible to help you acquire the necessary funds for any needs.

What Kinds of $500 Loans Are Available?

$500 loans have emerged as versatile financial tools, offering a lifeline to those navigating unexpected expenses or seeking a instant financial boost. These loans come in various forms, each tailored to specific situations and preferences. In this comprehensive guide, we will delve into the different types of $500 loans, shedding light on their unique characteristics, benefits, and considerations for prospective borrowers.

Personal Loans

- Unsecured loans

- Requires good credit score and stable income

- Versatile use of funds

Personal loans are a go-to option for those seeking financial flexibility. Borrowers can use $500 for various personal needs, whether it’s for medical bills, home repairs, or debt consolidation. The significant advantage is that they are typically unsecured, meaning borrowers do not need to provide collateral. However, to secure a such $500 loan, a good credit score and a stable income source are generally required.

Payday Loans

- Speedy approval process

- Ideal for immediate financial needs

- Suitable for those with less-than-perfect credit

Payday loans, also known as cash advance loans, provide an instant solution for immediate financial needs. With these loans, you can typically borrow $500 and repay it with your next paycheck. The application process is straightforward, making it an accessible option for individuals with less-than-perfect credit scores. However, borrowers should be cautious as 500 cash advance loans often come with high-interest rates, which can lead to a cycle of debt if not managed responsibly.

Installment Loans

- Repaid in fixed installments

- Suitable for those who prefer spreading repayments

- Credit history and income considered for approval

Installment loans allow borrowers to receive $500 upfront and repay it in fixed installments over an agreed-upon period. This option is ideal for individuals who prefer spreading their repayment over several months, making it more manageable. Lenders often consider your credit history and income when approving installment loans, which means having a good credit score and stable income can increase your chances of approval.

Emergency Loans

- Designed for urgent situations

- Approval based on the ability to repay

- Accessible to a wide range of borrowers

When unexpected emergencies strike, emergency loans can be a lifesaver. These loans are specifically designed to provide fast access to $500 for urgent situations such as medical emergencies or car repairs. Approval for emergency loans is typically based on your ability to repay, making it accessible to a wide range of borrowers, including those with lower credit scores.

Title Loans

- Requires collateral (e.g., vehicle)

- Provides fast cash

- Risk of losing the asset if unable to repay

Title loans require borrowers to use a valuable asset, such as a vehicle, as collateral to secure a $500 loan. This option can provide fast access to cash, making it suitable for individuals in need of immediate funds. However, borrowers should be cautious, as failing to repay a title loan can result in the loss of the collateral asset, such as your car.

Cash Advances

- Similar to payday loans

- Shorter repayment periods

- Ideal for smaller sums, like a $500 cash infusion

Cash advances are akin to payday loans but often come with shorter repayment periods. They cater to individuals in need of smaller sums, such as a $500 cash infusion to cover unexpected expenses. Borrowers should be aware of the higher interest rates associated with cash advances and ensure they can repay the loan within the specified timeframe.

Types of Cash Advance Loans:

a. Emergency $500 Cash Advance

In dire situations, an emergency $500 cash advance can be a crucial bridge between paychecks, ensuring you can promptly cover unexpected costs. However, due to their short-term nature, borrowers must have a clear plan for repayment.

b. $500 Cash Advance for Unemployed Customers

Even if you are currently unemployed, you may still access a $500 cash advance by demonstrating an alternative source of income, such as government benefits or a pension. However, ensure you have a reliable repayment strategy in place.

c. $500 Cash Advance for Students

Students facing financial constraints can rely on a $500 cash advance to cover tuition fees, textbooks, or other educational expenses. It’s essential for students to practice responsible borrowing and have a budget in place to manage their finances effectively.

Benefits of a 500 Dollar Loan

It’s essential for borrowers to carefully consider these advantages and disadvantages before taking out a $500 loan to ensure they choose the option that aligns with their financial situation and needs. Responsible borrowing and timely repayments are crucial to making the most of these financial tools.

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Accessibility | Easily obtainable for most borrowers | High interest rates may make repayment challenging |

| Speed | Instant approval and disbursal | Short repayment terms can create financial strain |

| Convenience | Can be used for emergency expenses | Limited borrowed sum may not cover all needs |

| Minimal requirements | Minimal credit check and paperwork | Defaulting can harm credit score |

| Improving credit | Timely repayment can boost credit score | Non-repayment can lead to collection efforts |

| Unsecured nature | No collateral required | Interest and fees can exceed principal amount |

Can I Get a $500 Loan with Bad Credit?

Were there periods when you didn’t repay the debt on time and in full? Is your current credit rating below 500? We are not going to judge you for what you’ve done or haven’t done. Our main goal is to support and provide you with professional advice. Thus, we are dealing with a wide database of creditors across the country who are ready to fulfill your money need and give out even a 500 loan for borrowers who don’t have the time to repair it.

If you want to apply online, fill in the small application on our website with your banking and private data. Once this information is checked and reviewed, you may be contacted by one or several creditors who will offer you their terms. It’s up to you to make the final decision and sign the agreement with the most suitable lender and be able to get a loan anywhere you are. The funds can be deposited on your valid banking account as soon as the next day upon approval.

500 Dollar Loan with a Poor Credit Score – Impact on rating

A poor credit score, typically below 580, can hinder your ability to online loans. Borrowers with poor credit often resort to payday loans or installment loans when in need of fast cash. These online loans are available for those with low credit scores, regardless of your credit history.How Much Does a $500 Cash Advance Loan With No Job Cost in Different States?

In various states across the USA, obtaining a loan without employment can be a pressing need. When facing financial challenges, it’s essential to know that options are available. Regardless of your credit score, some lenders offer short-term loans, often starting at $500, for individuals with poor credit.

Banks and credit unions may not be the ideal choice in such situations. This intro explores how to secure a loan now and get approved, even when traditional avenues may not be an option.

The cost and loan amount in each state are primarily determined by state-specific regulations and lending laws. These regulations govern the maximum borrowed sum and the interest rates that lenders can charge.

For instance, in Alabama, you can borrow $500 with an interest rate of 17.5%, resulting in a total repayment of $587.50. In California, the same $500 loan carries a lower interest rate of 15%, leading to a total repayment of $575. In Florida, the interest rate is 14%, making the total repayment $570. Texas offers the lowest interest rate at 10%, resulting in a total repayment of $550 for a $500 loan.

These variations occur because states have different usury laws and consumer protection measures in place. Therefore, borrowers should be aware of their state’s specific regulations when seeking loans to understand the cost and repayment amount associated with their borrowing needs.

| State | Loan Amount | Interest Rate | Total Repayment |

| Alabama | $500 | 17.5% | $587.50 |

| California | $500 | 15% | $575 |

| Florida | $500 | 14% | $570 |

| Texas | $500 | 10% | $550 |

What Should I Do to Increase My Chances of Getting a $500 Payday Loan?

-

Avoid Late Payments: Timely payment of bills and debts is crucial for maintaining a good credit score. Late payments can negatively impact your credit background, making it harder to secure loans or credit in the future. Consistently paying on time helps build a positive credit profile.

-

Use Connecting Services with Multiple Lenders: Utilizing connecting services that work with multiple direct lenders can broaden your loan options. These services match borrowers with suitable lenders, increasing the chances of finding favorable loan terms and interest rates, particularly if you have specific financial needs or credit challenges.

-

Prepare Income Confirmation: Having proof of a stable income is essential when applying for loans. Lenders typically require income verification to assess your ability to repay. Providing this documentation in advance can streamline the loan application process and improve your chances of being approved for the loan amount you need.

Risks Of An Instant $500 Cash Advance or Payday Loan From A Direct Lender

Taking out a fast loan for $500 from a direct lender through an online application can carry certain risks, especially for individuals with a bad credit score.

-

Credit Check: While some direct lenders may claim to offer loans without a credit check, many still do. If your credit is poor, a credit check can lead to higher interest rates, making the loan more expensive.

-

High Interest Rates: Quick loans often come with steep interest rates, and failing to repay the loan on time can lead to additional fees and interest charges.

-

Hidden Fees: Loan terms and conditions can include hidden fees that borrowers might not be aware of initially, increasing the overall cost of the loan.

-

Short Repayment Window: Quick loans often have short repayment periods, sometimes as short as one business day. This can make it challenging for borrowers to meet their financial obligations.

Before applying for a loan, it’s crucial to carefully review the terms, understand the risks, and consider alternative options to ensure the loan is a suitable solution for your financial needs.

Frequently Asked Questions

How Quickly Can I Get $500?

Getting $500 quickly depends on various factors. If you have a stable income and demonstrate your ability to repay the loan, you may receive fast approval for a loan request. Some lenders offer cash advances with no checks, which can expedite the process. However, it’s essential to review the terms and fees associated with such loans, as they can be costlier. Generally, online lenders can provide a quick turnaround, often within one business day, while traditional banks may take longer.

What Information Will I Need To Include When Applying For A $500 Cash Advance?

When applying for a $500 cash advance, you typically need to provide personal information like your name, address, and contact details. Unlike a traditional loan, cash advance no credit check often doesn’t require a hard credit check, so you may not need to provide extensive credit details.

However, some lenders may perform a soft credit check or request proof of income to ensure your ability to repay. Information like your bank account details and employment status may also be required. Keep in mind that while it’s a “no credit check” loan, some lenders may still report to credit bureaus, which can impact your financial background.

Why Should I Borrow A $500 Cash Advance?

Borrowing a $500 cash advance can be beneficial, especially for people with bad credit. These loans are designed for individuals who need a quick $500 loan and may have difficulty getting approved for a traditional loan due to their financial background.

500 cash advance no credit loans are short-term loans, providing a fast solution for immediate financial needs, like unexpected bills or emergencies. However, it’s essential to be aware of the high approval rates and fees associated with such loans and to use them judiciously to avoid a cycle of debt.

Do I Need Collateral To Borrow $500?

In most cases, you don’t need collateral to borrow $500. This type of loan is typically unsecured, meaning it doesn’t require you to pledge assets like a car or home. However, lenders may assess your ability to repay and may require a credit check. Collateral is more common in secured loans, and borrowing $500 is often achievable without it. Repaying such loans on time can even help improve your credit score if the lender reports your payments to credit bureaus.

How to get a $500 dollar loan with no job?

If you need a 500 dollar loan with no credit, getting such loan with no job can be challenging, as most lenders require proof of income to ensure you can repay your loan. However, some options like borrowing from friends or family or applying for a small loan from certain lenders may be available. Keep in mind that not repaying your loan can negatively affect your credit score, so it’s essential to explore your options carefully and consider the potential impact on your credit.

Can I Get a $500 Loan with Bad Credit?

Yes, you can typically get a $500 loan with bad credit. Many online lenders offer options like a $500 cash advance without any checks. These lenders focus on your ability to repay. However, banks and credit unions perform traditional credit checks and have stricter criteria. To increase your chances of approval, explore online lenders specializing in small loans and ensure you can meet the loan repayment terms.